Review Tampilan Situs Slot Link ALternatif RMK 828 Terpercaya – Ada banyak unsur yang bisa menjadi ciri situs Slot Link ALternatif RMK 828 terbaik dan terpercaya. Situs slot di masa ini hadir dengan kualitas berbeda sehingga sebagai player judi anda wajib selektif saat memilih situs sebagai akses bermain judi anda. Jika anda salah saat memilih situs untuk akses bermain maka anda akan dirugikan oleh situs lewat sistem taruhan maupun hal lain dari slot ini.

Untuk bermain judi slot di dalam situs pastikan anda tahu ciri situs yang memiliki mutu terbaik. Jika hal ini anda ketahui maka betting slot judi yang anda mainkan akan lebih aman dan nyaman. Banyak ciri situs judi terbaik yang bisa anda ketahui dan cari dengan mudah di dalam situs yang menjadi tujuan anda, salah satu contohnya adalah tampilan dari situs penyedia game slot judi.

Situs Slot Link ALternatif RMK 828 Terbaik Berikut Review Tampilan Menariknya

Tampilan yang dimiliki situs judi terbaik memiliki unsur yang bisa sama dari situs abal – abal. Ada banyak hal menarik dari tampilan situs judi terbaik dan hal ini wajib untuk anda pastikan dalam situs yang akan anda mainkan. Jika anda ketahui unsur apa saja yang terdapat dalam tampilan situs slot maka kesempatan untuk anda menemukan situs terpercaya cukup besar. Di bawah ini telah kami ulas review tampilan menarik yang dimiliki oleh situs penyedia slot judi online terpercaya.

• Memiliki Banyak Menu

Menu yang banyak dan lengkap menjadi salah satu unsur yang bisa anda temukan di tampilan situs judi. Menu dengan fungsi yang tidak sama jelas sangat penting untuk anda perhatikan dan oleh sebab itu, hal ini penting diketahui agar anda tidak salah memilih situs betting slot judi online.

Menu – menu lengkap dari situs RMK828 tentu saja dapat anda pakai untuk mengakses beberapa hal yang penting. Anda dapat memakai menu dari tampilan situs ini dengan mudah dan maka dari itu, hal ini penting untuk anda perhatikan agar menu dari situs dapat anda akses sesuai fungsi.

• Menyediakan Ulasan Seputar Situs

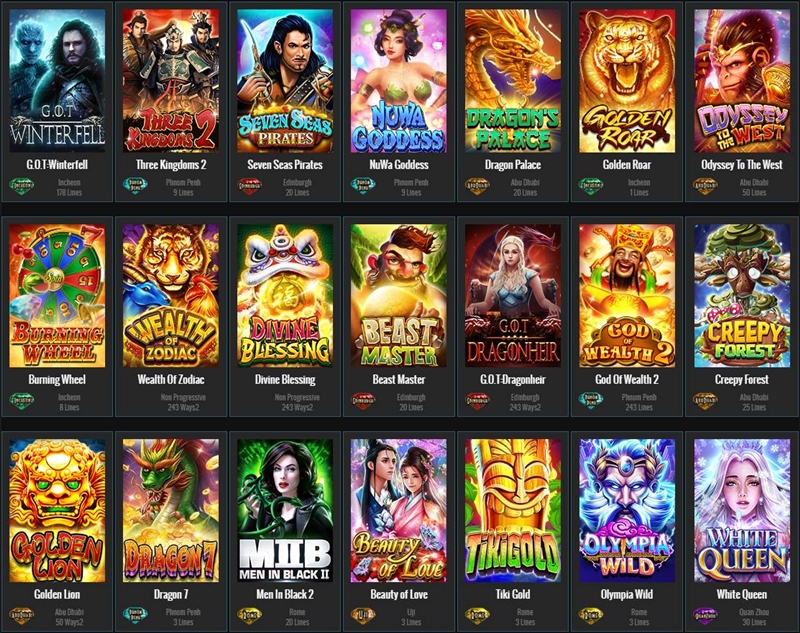

Unsur lain yang dimiliki oleh situs judi pada tampilan adalah ulasan seputar situs tersebut. Slot Link ALternatif RMK 828 dari situs terpercaya akan memberi Anda ulasan yang sesuai dengan situs judi, misal layanan menarik yang disediakan maupun provider yang sudah menjalin kerja sama pada situs.

Ulasan – ulasan seputar fitur menarik juga akan diberikan untuk anda sehingga hal ini menjadi hal yang akan meyakinkan anda. Anda dapat bermain dengan keyakinan di awal pada situs setelah melihat ulasan yang disediakan oleh pihak situs slot terpercaya tersebut.

• Memberikan Info Promo

Terakhir adalah info promo dari situs slot game. Info seputar promo dan bonus menarik juga akan diberikan untuk anda melalui tampilan. Anda bisa scroll ke kanan dan ke kiri untuk mencari tahu info promo lain dari situs.

Dengan info promo yang disediakan oleh situs maka anda akan lebih tertarik untuk bermain judi slot pada situs serta memperoleh keuntungan promo yang sudah ditawarkan oleh situs tersebut. Jelas tampilan seperti ini hanya ada pada situs betting yang terpercaya.

Selesai sudah ulasan yang dapat kami sajikan untuk anda mengenai tampilan dari situs Slot Link ALternatif RMK 828 terpercaya. Ketahui unsur lain yang ada dalam situs terpercaya jika anda ingin bermain di akses situs yang tepat dan terbaik sehingga sistem dari judi lebih aman.